- Money Blues Newsletter

- Posts

- Why I want to talk to you about money

Why I want to talk to you about money

Welcome to the first edition of the newsletter

Photo by Vanessa Murrieta on Unsplash

People don’t like to talk about money. I am probably correct in calling it a bit of a taboo to be honest. It’s not a thing you discuss much even with your closest friends or family over dinner or on WhatsApp group chats. Most of us have probably grown up with parents who didn’t teach us much about finance either.

I’ve not heard anyone openly share their salaries, saving tips, things they learn about investing, how pensions work, what compounding really looks like long term or the difference between all the ISAs. This really helps no one.

That’s why I want to open up the conversation around money in this newsletter and share the things I’m learning and finding useful as I get deeper into the personal finance world. If this helps you in some way to feel better about money decisions or maybe sort out your random pension pots as a result of this, I’d love to hear from you!

Women are behind, but we don’t have to be

It may come as no surprise that gender gaps exist even in the personal finance world. Women on average are less confident in handling their money and especially in banking and investments. Up until fairly recently (1975 to be precise), we weren’t even allowed to have a bank account in our name in the UK and were qualified as a high risk investment! No wonder why this gap exists…

I want to dedicate a whole post to this topic in the future, so stay subscribed ✌️

My weekly recommendation

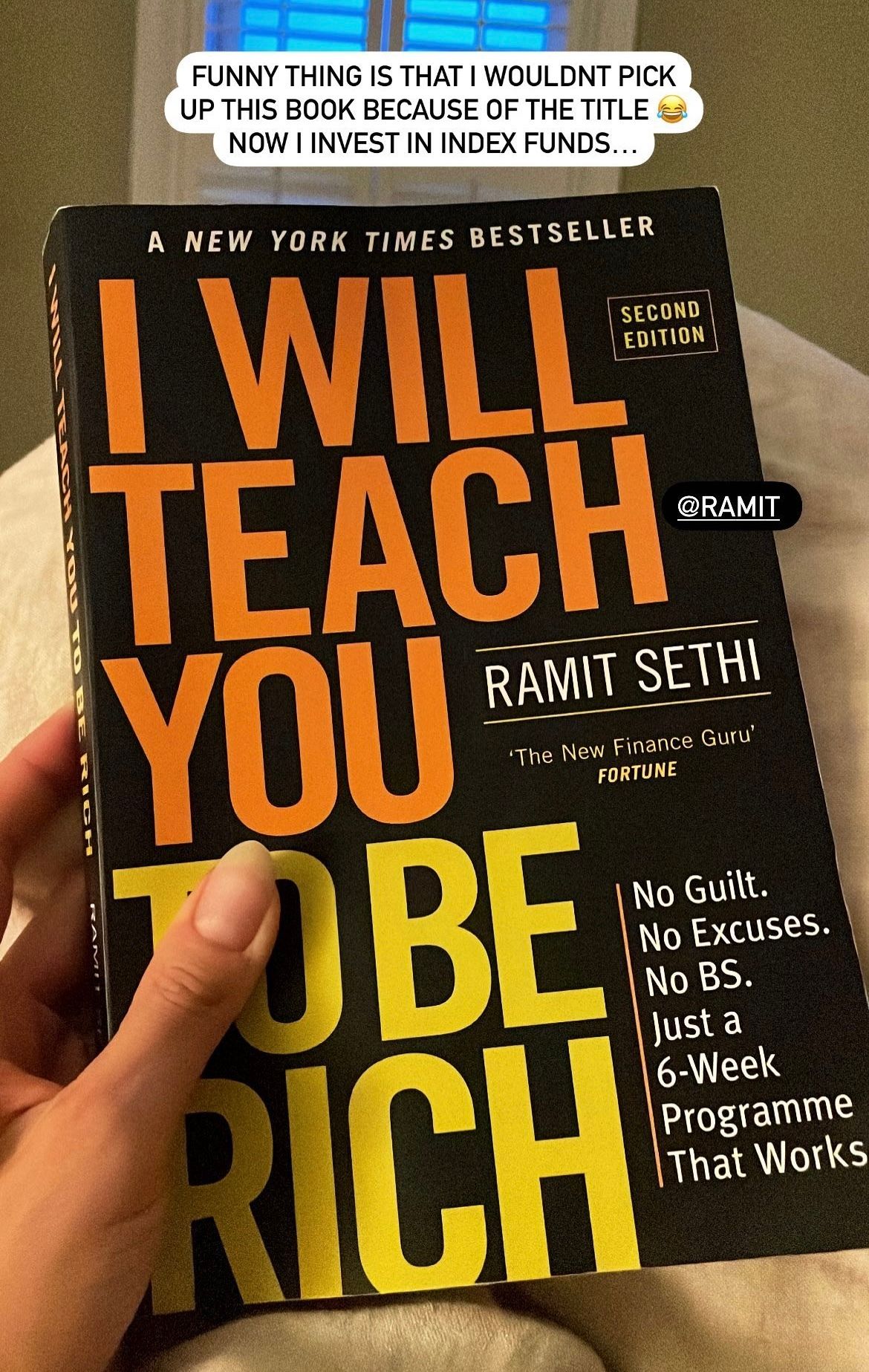

I want to thank my partner Sam, who recommended me Ramit Sethi’s book I Will Teach You To Be Rich as well as his podcast and the Youtube series where he candidly talks to couples about their financial situations. It’s like an open therapy session, but people talking about money! Absolutely fascinating. I feel that shows like this helps to lift the taboo on the subject of money especially within couples 👫🏼

This book is full of simple actionable steps and easy to understand financial education. It’s a good starting point if you want to get your money in order and simply feel better about the financial decisions you are making.

📖 Don’t be put off by the title like I was!

You can order a copy here.

Let’s build financial confidence together ✨

#RichLife

If you think someone else might be interested in personal finance or would enjoy reading this newsletter, you can share the subscription link below or simply forward this email.

Thank you 🙏

Lina

Reply